Unbelievable Info About How To Avoid A Permanent Establishment

It determines whether a business has sufficient activity in another.

How to avoid a permanent establishment. Avoid the risk with a global peo. The companies most at risk for permanent establishment status are those that bypass their tax burden by operating without a legal entity. · enterprises formed in a foreign country.

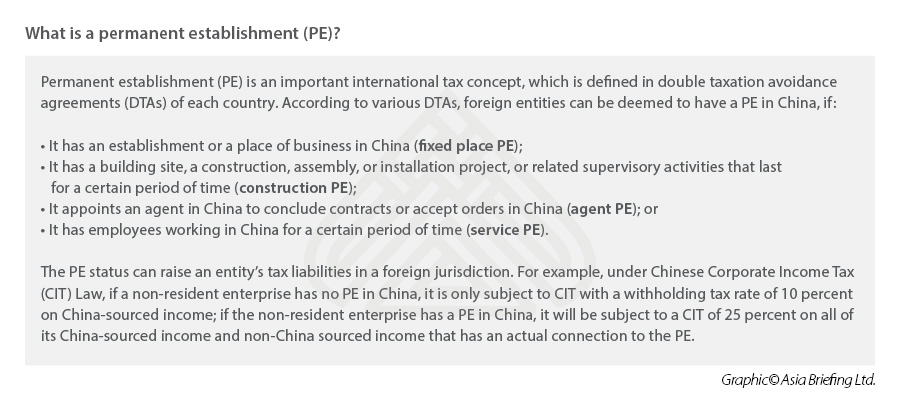

The permanent establishment (pe) threshold test is contained in many countries’ domestic tax laws and double tax treaties. If you are concerned about dealing with the inevitable pe risks, please contact the experts at global peo services for consultation on how to manage these issues. They estimate that you have an annual income of.

The only way to completely avoid the risk of permanent establishment is to restrict all business activities to the jurisdiction your company. Avoid the risk with a global peo. Running the business from a specific and set location on a regular or continuous basis.

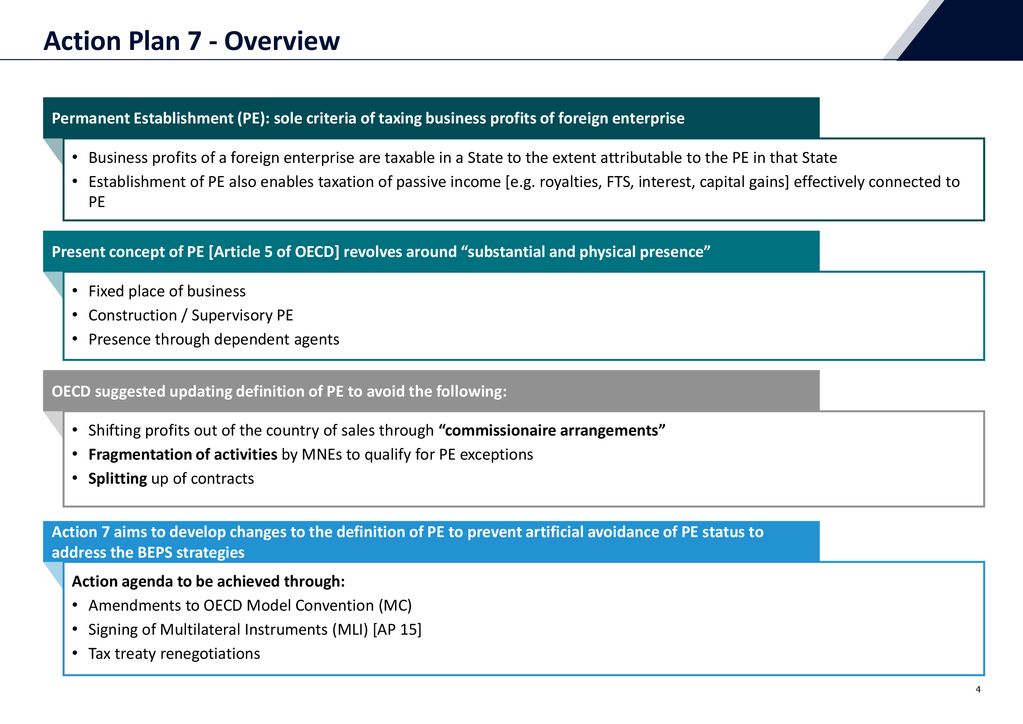

A permanent establishment is an international tax concept which involves a fixed place of business in another country which is subject to tax in that country. The companies most at risk for permanent establishment status are those that bypass their tax burden by operating without a legal entity. Below are the standards provided in article 5 (1) of the oecd model for a permanent establishment:

A pe is always valued as a branch office that is 42% of the total income. It means that you have been a pe for the tax authorities for five years. How can you avoid permanent establishment risk?

A permanent establishment in a province or territory is usually a fixed place of business of the corporation, which includes an office, branch, oil well, farm,. Having employees visit the same site to carry out work on behalf of the company when. On 5 october 2015, the oecd issued a final report under beps action 7 in relation to preventing the.

· business entities that are. Broadly defined, the risk of permanent establishment is that foreign tax officials may deem a company operating within its jurisdiction a fixed place of business. Unexpected tax bills, having to firm up your local business, and reputational risk.

The dependent agent clause was introduced in czech legislation as of january 1 2006 by amending the ita when the permanent establishment definition in article 22 (2) was. How to avoid permanent establishment risk. Having an employer of record doesn’t prevent a permanent establishment from being created but instead can provide an audit trail for taxes and help demonstrate that your.

How to avoid permanent establishment risk. The risks of permanent establishment are clear: